The Untold Stories of Family Business

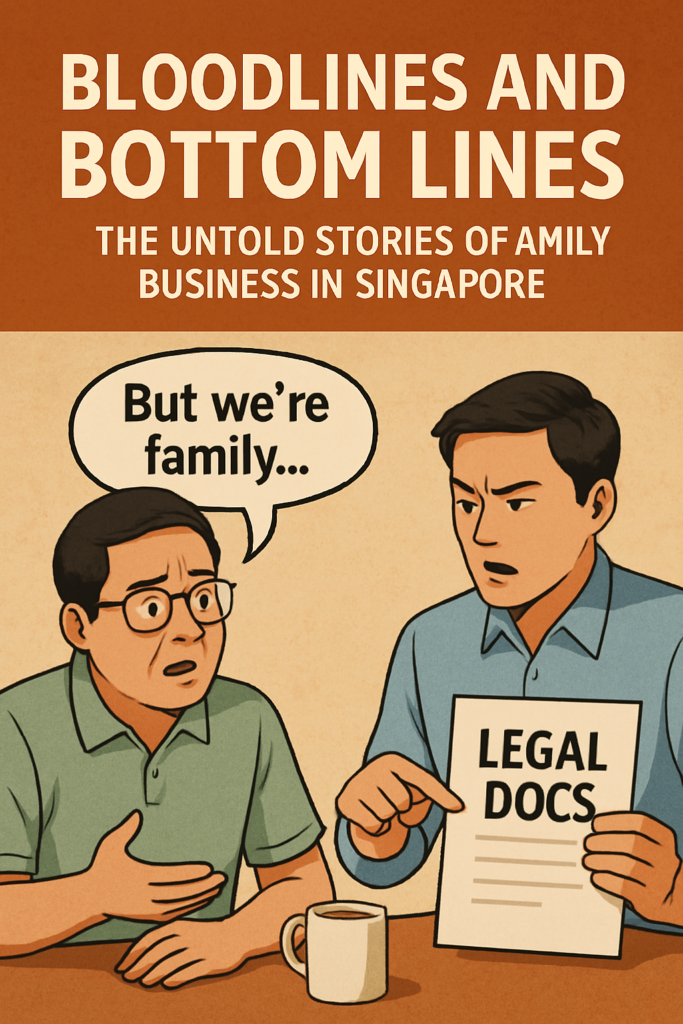

So, we’ve talked about what goes wrong when family businesses run on vibes (aka verbal promises and “don’t worry, we’re brothers”).

It’s okay. You’re not alone. I’ve worked with dozens of family-run businesses in Singapore, and I can tell you—most of them only call a lawyer after the family group chat becomes a war zone.

But here’s the thing:

Legal structure is not the enemy of trust. It’s the insurance for it. It also helps to preserve the family ties because it keeps everyone accountable and responsible to each other.

So let’s talk about how to protect your family and your business.

☕ “But We’re Family… You Really Need Legal Docs?”

Yes. Especially because you’re family.

Let me give you an analogy. You wouldn’t build a $10 million property without the building authority’s approval, right? You wouldn’t pour concrete without architectural drawings. But so many families build entire empires based on a few WhatsApp messages and some nods over dinner.

That’s why when disputes happen, the question isn’t “What’s fair?” It becomes “What can you prove?”

📝 1. The Shareholder Agreement: Your Family Constitution

Think of this as the “terms and conditions” for being in the business.

A good shareholder agreement covers:

- Who owns what % of the company (and what happens if someone wants out)

- How dividends are paid

- Decision-making rules (Can you buy a new shophouse without a vote?)

- Dispute resolution mechanisms (Mediation first? Or straight to court?)

Bonus tip: Include a pre-emption clause—it gives existing shareholders the first right to buy shares before they’re sold to outsiders. Super helpful if someone suddenly wants to cash out.

True story: I once advised a family business where one of the cousin sell his stake to a complete stranger out of spite. The rest of the family was furious (of course), but legally, they couldn’t stop it—because there were no pre-emption clause.

👥 2. Roles, Titles & Salaries: Don’t Assume, Define

Every business needs clarity on who does what. Even more so in a family business where Auntie Susan “helps with accounts” and your brother “sort of manages sales.”

Write it down:

- Job descriptions

- Reporting lines

- Compensation packages

- Performance expectations

Set KPIs. Have performance reviews. Yes, even if it’s your eldest son.

Because guess what? When one sibling feels like they’re doing more but getting paid less—it festers and resentment grows fast.

🧓 3. Succession Planning: The Taboo We Need to Talk About

Nobody wants to think about Dad/Mom stepping down. But what’s worse? A business with no leadership plan.

Succession planning isn’t just about who takes over. It’s also:

- How do you train the next gen?

- When does decision-making transition?

- What happens if the chosen successor doesn’t want it?

Start with a family alignment session. Get everyone to articulate their hopes and fears. Then work with a neutral third party—a coach, lawyer, or trusted advisor—to design a phased transition.

“Later then discuss” is not a plan. It’s a delay with a time bomb attached.

📃 4. Wills & Estate Planning: Because You Can’t Take It with You

Here’s where things get really sensitive. But if you don’t have a proper will (or trust), you’re handing your loved ones a problem, not a legacy.

Without a will:

- The law decides how your assets are distributed (under the Intestate Succession Act)

- Your family might end up in court fighting over what they thought you wanted

- Business shares might go to someone who’s never lifted a finger in the company

You don’t need to be a billionaire to need estate planning. You just need to care about what happens to your business—and your family—after you’re gone.

👨👩👧👦 5. Family Charter: Optional, But Gold

This is less legal, more cultural. A family charter outlines your shared values, vision, and principles for working together. It can include:

- What the family believes about money

- Who can work in the business (must be qualified? Married in?)

- Rules about loans, guarantees, or investing family funds

It’s like a mission statement—but for keeping the family grounded.

“Okay lah, but won’t all this make things awkward?”

Maybe for one or two meetings, yes.

But awkward conversations now prevent ugly conflicts later. I’ve seen families come out of these discussions closer, more aligned, and with a renewed sense of purpose.

Imagine how powerful it is to say:

“We love each other too much to let business tear us apart. That’s why we’re doing this.”

Let’s Make It Real: The Contract Checklist

✅ Shareholder agreement in place

✅ Roles and salaries defined in writing

✅ Succession plan started

✅ Wills and trusts reviewed

✅ Annual family business meeting scheduled