Series: Bloodlines and Bottom Lines – The Untold Stories of Family Business.

You know what no one tells you about family business fallouts?

It’s not just the court cases, the legal bills, or the company registrar changes.

It’s the silence at reunion dinners (in extreme cases, no dinner at all). The siblings who used to go for breakfast together every Saturday… now don’t even reply in the family group chat.

We’ve followed the Tan brothers’ journey—from shared dreams and unspoken assumptions to full-blown litigation. But what happens after the court doors close?

Can families ever come back from a business fallout?

The answer—thankfully—is yes.

But not without some honest reflection, real conversations, and sometimes, the courage to choose peace over profit.

💔 The Aftermath: Broken Bonds, Heavy Hearts

After the Tan brothers settled their case, the legal issues were resolved. But the emotional damage? That lingers.

Ah Tong told a friend, “I didn’t want to fight. I just didn’t want to be erased.”

And that’s the thing. Most family business disputes aren’t about greed. They’re about dignity.

About wanting to be seen, acknowledged, included.

The courtroom can settle ownership. But reconciliation? That takes a different kind of work.

🕊️ The Path to Healing (Yes, It’s Possible)

Let’s talk about what it takes to rebuild, based on what I’ve seen from families who’ve managed to do it—and those who couldn’t.

1. 🤫 Accept that some things may never be said.

Not everyone will apologise. Not every wound gets a neat explanation.

Families who reconcile often stop expecting the “perfect closure” and start building new trust, from today onwards.

✅ Focus on the future. Don’t get stuck relitigating the past.

2. 🗣️ Talk—but with boundaries.

Sometimes, the best thing you can do is bring in a neutral third party: a coach, therapist, mediator, or trusted elder.

These aren’t “soft skills”—they’re survival tools. When emotions run deep, you need structure and safety for the conversation to be productive.

✅ Create structured spaces to talk. Not every dinner is the right time.

3. 🧠 Get clear on values before vision.

Before talking about “next steps,” talk about what matters most. What does the family really value?

Is it legacy? Harmony? Growth? Freedom?

If your values diverge, that’s okay. It might even point to a healthy decision to separate business and family without bitterness.

✅ Start with shared values. Vision comes after.

4. ✋ Know when to walk away—with grace.

Some wounds are too deep. And sometimes, the healthiest thing you can do is let go of the business to save the family.

This doesn’t mean you “lost.” It means you’re wise enough to know that not all capital is financial.

✅ Peace is a return on investment too.

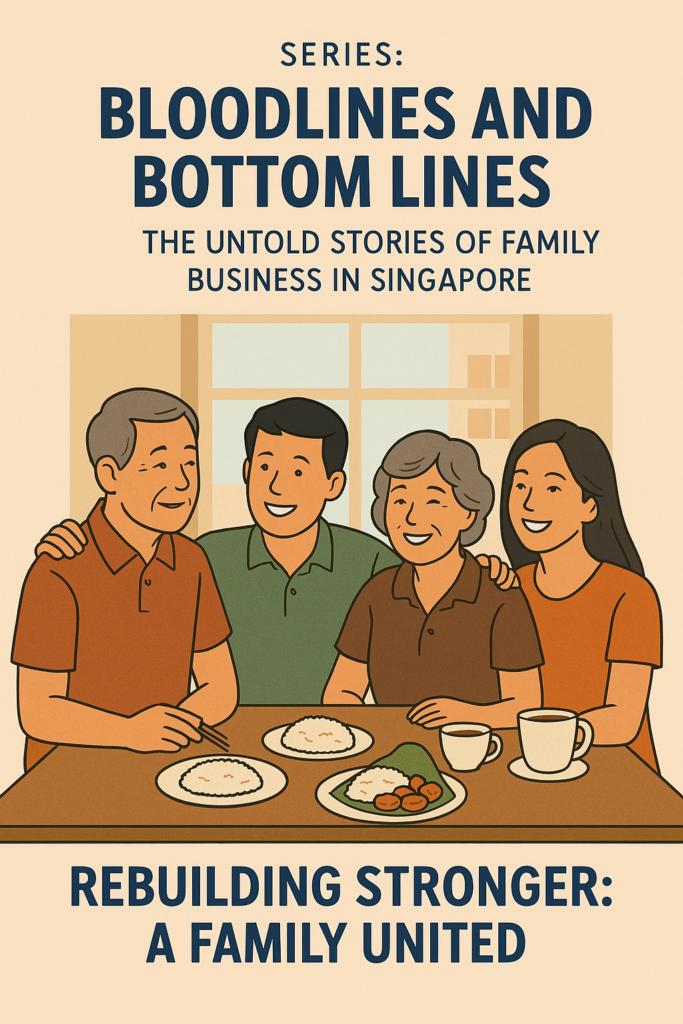

🪙 Peace Over Profit… Or Both?

Here’s a story I’ll never forget.

A client of mine, a second-gen founder named Andrew once told his dad, “I don’t want the company if it means losing my siblings.”

That moment changed everything.

Instead of pushing for titles and control, they brought in an external CEO, wrote down the family values in a charter, and focused on harmony.

Today, the siblings still own the business—but they’re not in each other’s way. And during Chinese New Year, they can still sit at the same table and laugh over fish skin crackers and childhood stories.

That, my friend, is real wealth.

💬 Questions to Reflect On (or Discuss Over Dinner):

- What’s more important to me—being right, or maintaining the family relationship?

- Have I ever assumed someone knew what I expected… without saying it?

- If this business ended tomorrow, what would I want to remain?

🧭 The Big Takeaway: Build with both Head and Heart

Family businesses are sacred. They carry our hopes, our hustle, our history.

But they’re also fragile—held together not just by contracts and KPIs, but by trust, memory, and shared meaning.

If we want to build something that lasts beyond our generation, we need:

- Structure and softness

- Governance and grace

- Logic and love

That’s a Wrap 🎉

Thanks for joining me on this journey through the world of family business. From messy beginnings to tough conversations and hopeful rebuilds, I hope you saw a bit of your story—and found something useful for the road ahead.

👉 What resonated most with you from this series?

👉 Have you been through something similar in your own family business?

Drop a comment, send a DM, or share this with someone who needs to read it.

And if you’re looking to start your own “family alignment” process—I’ve got tools, templates, and plenty of real life case studies/stories to help.

💌 Let’s Keep the Conversation Going:

👉 What resonated most with you from this series?

👉 Have you been through something similar in your own family business?

Drop uncle an email (TalkTo@unclehuat.com) , or share this with someone who needs to read it.

And if you’re looking to start your own “family alignment” process—I’ve got tools, templates, and plenty of real-life stories to help.